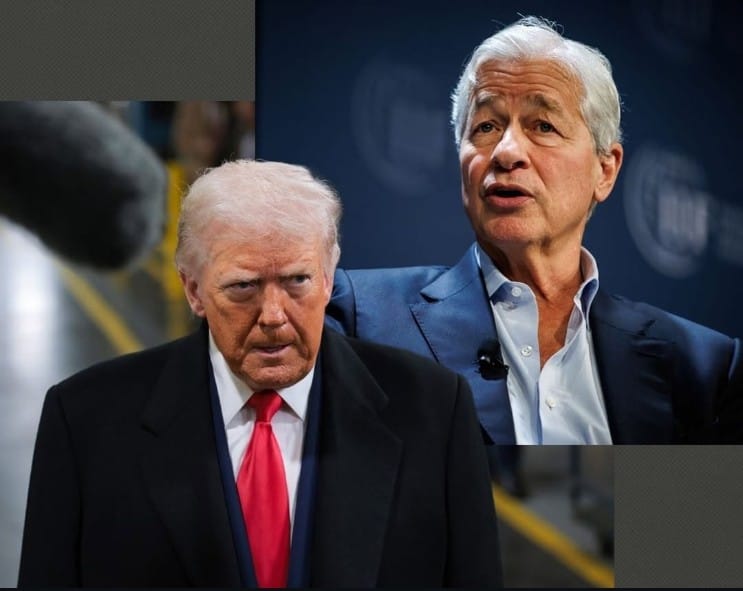

US President Donald Trump has filed a $5 billion lawsuit against JPMorgan Chase and its chief executive Jamie Dimon, accusing the bank of shutting his accounts for political reasons and unlawfully cutting him off from financial services.

The lawsuit was filed on January 22 in a Florida state court in Miami-Dade County. Trump alleges that JPMorgan violated its own internal policies by singling him out and closing accounts linked to him and his hospitality businesses to align with a political agenda. According to the complaint, the account closures caused financial disruption and reputational damage to Trump and his companies.

Allegations of Blacklisting and Political Targeting

Trump claims that Dimon ordered the creation of a malicious “blacklist” warning other banks against doing business with the Trump Organization, Trump family members and Trump himself.

The lawsuit says Trump and his businesses were forced to approach other financial institutions to move funds, making it clear that they had been debanked. Trump argues this went beyond standard risk management and amounted to political targeting.

Speaking to reporters aboard Air Force One, Trump said he had not spoken with Dimon about the lawsuit. “You’re not allowed to do what they did,” he said, suggesting regulators may have influenced the bank’s actions.

JPMorgan Rejects Claims and Defends Policy

JPMorgan denied the allegations, saying it does not close accounts for political or religious reasons. “While we regret President Trump has sued us, we believe the suit has no merit,” the bank said in a statement. It added that account closures occur only when legal or regulatory risks arise and that such decisions are often driven by regulatory expectations.

The bank said it respects Trump’s right to sue and its own right to defend itself. JPMorgan shares closed 0.5 per cent higher on Thursday and were flat in premarket trading on Friday.

Debanking Claims Draw Wider Scrutiny

The lawsuit comes as claims of debanking have gained political traction, particularly among conservatives who accuse large banks of restricting services to certain individuals and industries.

In December, the Office of the Comptroller of the Currency said major US banks limited financial services to some sectors between 2020 and 2023, including oil and gas, cryptocurrency firms and firearms manufacturers. The regulator said it is reviewing thousands of complaints.

The case adds to growing tension between the Trump administration and the US banking sector as debates over regulation, political bias and access to financial services continue.