The US Firms contributed around $317 billion to the total revenue in the international arms market.

The U.S. has established itself as a strong arms exporter over a period of the past five years. This has seen an escalation such as continuing hostilities, due to the wars in Gaza and Ukraine, as well as rising tensions in Asia, which increased the demand for weapons globally. North America and Europe witnessed relatively modest rises of 2.4% and 0.2%, respectively, while companies in Asia and Oceania saw a 5.7% increase.

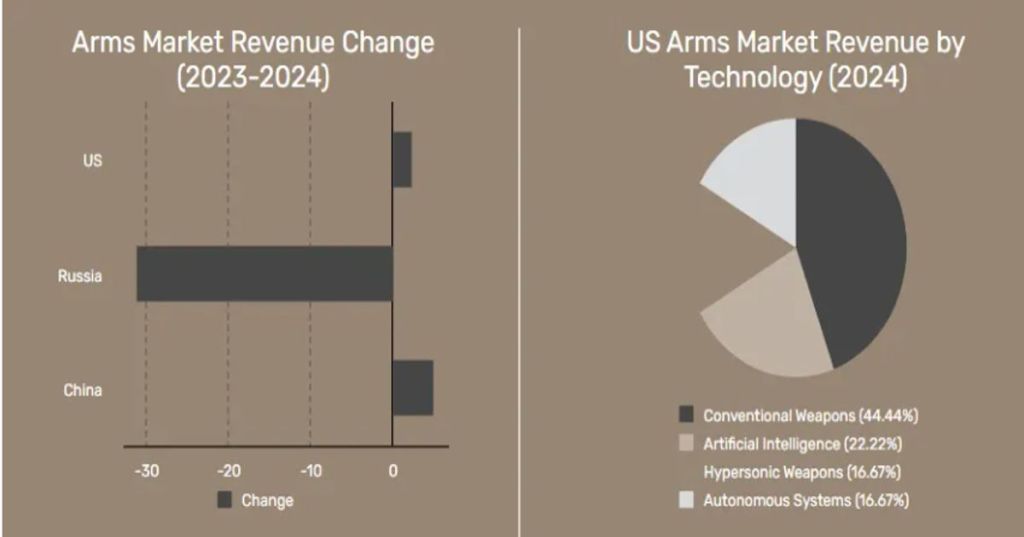

The U.S. companies saw a 2.5% increase in arms revenues altogether. The Stockholm International Peace Research Institute (SIPRI) has declared that 41 U.S. companies have been listed in the top 100 companies contributing to international arms revenue. The top two largest military producers in arms have been recorded as Lockheed Martin and RTX.

The U.S. government is continuously preaching for global peace but is standing as the highest supplier of arms producers. The question arises is it just garnering more and more profits or a mere strategic geopolitical move by the nation? With Donald Trump taking the Presidential charge on January 20, 2025, the world is seeking how he will accomplish his promise to end the Russia-Ukraine war within 24 hours.

While the Russia-Ukraine war has now spanned over 1000 days, Russia’s arms exports dropped 31%, indicating a sharp deterioration in its standing in the world market. Many countries are pivoting away from Russian military equipment due to reliability issues stemming from ongoing conflicts and sanctions against Russia. To reap the maximum benefit on business revenue and geopolitical relations, the U.S. has strengthened defense ties with allies such as Australia, Japan, and South Korea, which are increasingly turning to American weapons amid regional security concerns. Even nations like Poland and Germany have made substantial purchases, including Apache helicopters and Chinook helicopters, respectively. By supplying advanced weaponry to allies and partners, the U.S. aims to counterbalance the growing assertiveness of adversaries like Russia and China.

But is the future of American arms exports assured?

With the rising defense autonomy in Europe to the escalating geopolitical tensions of Asia, the dominance of the U.S. market can face challenges. Furthermore, the Biden administration’s inclusion of human rights concerns in arms transfer guidelines suggests that the countries that receive US defense assistance may be reevaluating their priorities. This moral position might make it more difficult to sell to countries with a history of autocratic rule, which could change long-standing alliances.

What has been India’s stance while the U.S. made this strong positioning?

India has strictly been proactive in its major self-reliance defense strategy to carve out its own niche in the international arms market. India’s “Make in India” initiative is aiming more at indigenous production rather than foreign suppliers. India has also shown moderate growth marked by a 5.8% revenue increase to $6.7 billion in 2023. Companies like Hindustan Aeronautics Limited (HAL) and Bharat Electronics are leading this to focus on light combat aircraft, advanced radars, and naval shipbuilding.

While India has recently purchased Apache helicopters and the S-70B Seahawk multi-role naval helicopters, India’s ties with the U.S. also remain strong, The Indian market is emerging in the global market as a potential leader even as U.S. companies continue to dominate arms exports worldwide.