Before assuming office, newly elected U.S. President Donald Trump began focusing on policy formulation for the next four years, including departmental allocations. Trump had already devised his Plan 2025 months before the election. Several pages of these documents were secretly published by The New York Times and various other U.S. media outlets, revealing how Trump intended to implement significant changes within the bureaucracy and overhaul U.S. economic policy if he came to power.

Throughout his campaign and even before, Trump repeatedly discussed imposing heavy tariffs on competitive countries. This was not a new stance, but this time, Trump compiled a list of countries that export more to the U.S. than they import, which results in a trade deficit and harms the American economy. In economic terms, this is known as a trade deficit.

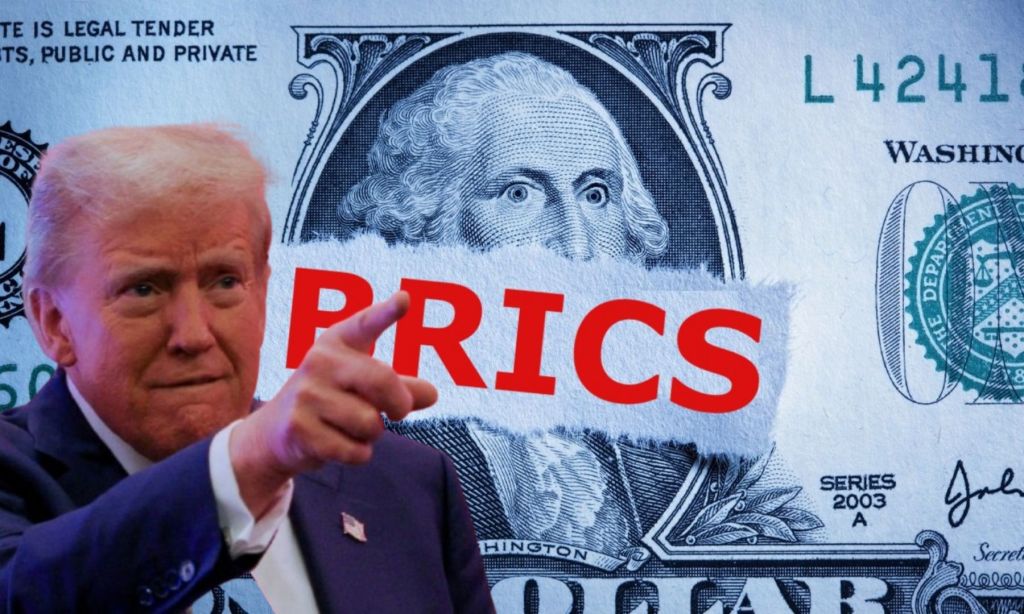

Trump posted on the social media platform X, saying, “BRICS countries are attempting to create a new BRICS currency. This is no longer a time to sit back and watch. We want assurances from these countries that they will neither create a BRICS currency nor support any currency other than the dollar. If any country does so, America will impose a 100% tariff on them. In other words, if a product previously sold for $100 in the U.S. market, it will now be sold for $200.” Trump sternly remarked that such countries would have to “find foolhardy nations” where they can sell their goods. He further emphasized that there was no chance that the BRICS currency could replace the U.S. dollar in international trade, and any country attempting this would have to bid farewell to the U.S.

How Did the BRICS Currency Initiative Begin?

Many countries, including China, Russia, and India, have been using their local currencies — such as the Yuan, Rupee, or other currencies — as alternatives to the U.S. dollar in international trade. However, after the Russia-Ukraine war in 2022, the U.S. removed Russia from the international SWIFT system and froze billions of dollars of Russian assets abroad. As Russia’s costs rose due to the war and sanctions imposed by the U.S. and other Western nations, it began relying more on countries willing to trade in local currencies. China took advantage of this by conducting all trade with Russia in Chinese Yuan.

This reliance on China grew steadily. In 2021-22, trade between China and Russia was valued at $1.5 billion; this figure has now soared to $250 billion. Significantly, all payments are now being made in Chinese Yuan instead of U.S. dollars. Following China’s lead, India also began settling trade with Russia in Rupees or Russian Rubles. In 2021-22, trade between Russia and India was worth $13 billion, but it has since surged to $66 billion, with all transactions conducted in local currencies.

In the wake of the pandemic and the subsequent global recession, many countries began promoting their local currencies for trade. At the 16th BRICS Summit in Kazan, all BRICS nations agreed to conduct trade in local currencies as an alternative to the dollar. Although no official BRICS currency was created, the countries seemed committed to this initiative. At the Kazan summit, Russian President Putin showed a sample BRICS note to his counterparts, but no formal discussion on a BRICS currency took place. During the 2023 summit, BRICS nations once again discussed the idea of a currency alternative to the dollar, but no consensus was reached at that time.

With Trump’s return to power, the agreement made at the Kazan summit in 2024 on conducting trade in local currencies might remain limited to paperwork, given Trump’s insistence on imposing 100% tariffs on countries using currencies other than the U.S. dollar.

Is the U.S. Worried About the Decline of the Dollar’s Value?

Currently, around 80% to 85% of global trade is conducted in U.S. dollars. The U.S. leverages the strength of the dollar to impose sanctions on countries worldwide. In recent years, China has lent billions in Chinese Yuan to several African and Caribbean countries. According to the Harvard Business Review, China has provided loans worth $1.5 trillion to 150 countries, compared to just $200 billion by the World Bank and IMF. This policy aims to increase the global value of the Chinese Yuan and exploit the resources of those countries.

This situation has raised concerns in the U.S. If all nine BRICS countries officially start trading in their local currencies, it could potentially erode America’s dominance. BRICS represents approximately 41% of the global population. According to the World Economic Forum, BRICS countries account for about 37% of the world’s GDP. The U.S. economy could face a significant blow if BRICS countries choose not to use the dollar.